Perhaps the greatest impact of COVID-19 on the future of money has been in the payments space. Our Logica® Future of Money study has shown a significant decrease in the use of cash. We have also seen a notable rise in the use of debit and credit cards, as well as payment apps, peer-to-peer payments and installment payment options. And PayPal usage is at an all-time high.

While these changes started before the pandemic, consumer adoption has been dramatically accelerated in today’s world. It appears the changes are here to stay—at least for a while. Americans are open to new ways to pay—and we expect the youngest generation of adults, Gen Zers, to lead the continued adoption of these next generation of payment options.

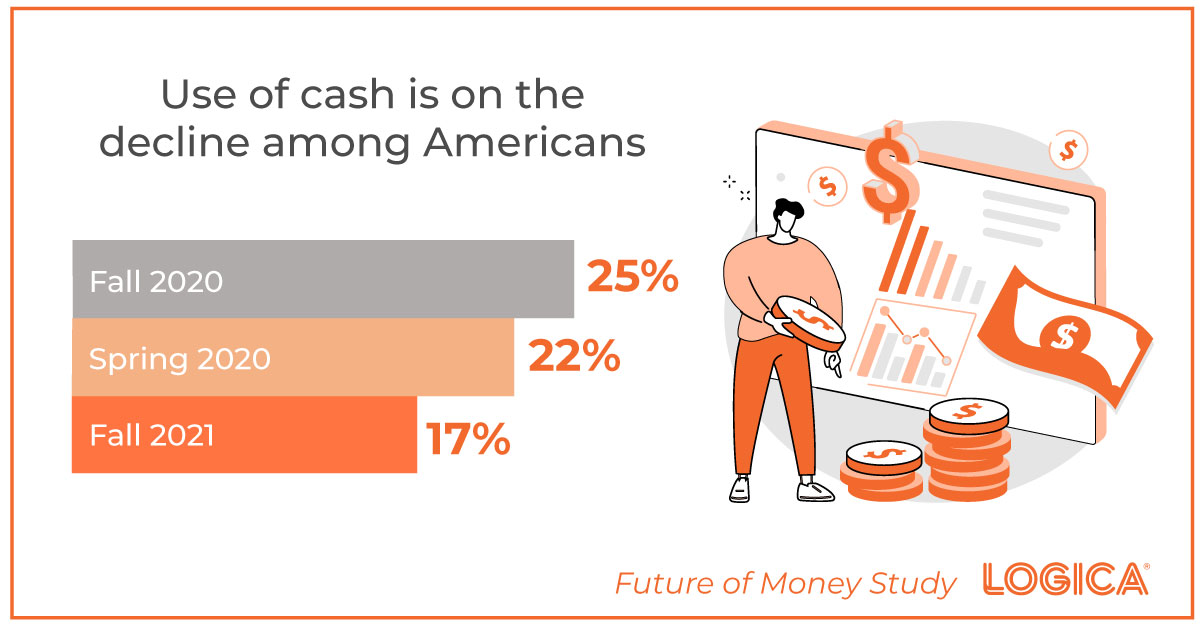

The Decline of Cash

One quarter (25%) of Americans reported that they used cash for their most recent in-person payment in Fall of 2019, but one year later in Fall of 2020, only 17% used cash for their most recent payment. According to a recent article from the BBC, the “coronavirus will hasten the decline in the use of cash as people make a long-term switch to digital payments,” and our research certainly supports this trend.

Popularity of Peer-to-Peer Payments

Twenty-seven percent (27%) of Americans are using peer-to-peer (P2P) payments more, with Gen Z and Millennials leading the way. According to PYMNTS.com, “P2P usage has picked up during the pandemic because it offers an incredibly easy way to casually exchange funds without making physical contact.”

“I use Apple Pay. I prefer it to a physical card because of COVID. My cousin owed me money and transferred it to me via Apple Pay and that’s how I started using it.

I think of it as cash.” —Qualitative interview participant, KNow Research interview for Logica® Future of Money Study, December 2020

And our Logica® Future of Money study shows that P2P usage is also up with Paypal at the forefront.

Buy Now/Pay Later is Booming

PayPal isn’t only leading the P2P trend, but also the Buy Now / Pay Later (BNPL) trend. Our study shows that PayPal Credit sees highest awareness and usage among BNPL options among Americans. BNPL is on the increase, with 14% of Americans reporting that they are using BNPL or installment plans more often now since March 2020. Fortune magazine notes “while the groundwork for BNPL services has been set for decades, the sudden ubiquity is almost to be expected given the suddenness of the recent economic downturn.”

Conclusions

There is no doubt that COVID has accelerated the decline of cash and adoption of new ways to pay. With the expansion of payment options, comes the necessity for merchants and B2B payment processors to optimize the customer experience and deepen engagement—to increase revenue, average account value, and lifetime value of customers.

- As payment options proliferate, consumers will be looking for easy, fraud-proof ways to pay that help them manage their cashflow—including card, payment apps, P2P and BNPL programs. Product marketing, communications and feature enhancements will need to continue to evolve to be competitive. Understanding what resonates most with customers is essential to creating the best customer experience.

- At the same time, merchants will need to navigate the payment options for their customers to optimize the check-out experience, particularly online. Understanding customer check-out needs is key.

- For payment platforms, understanding the end-to-end experience for both consumers and businesses, and how to evolve them, is critical.

Want to learn more?

Schedule a presentation for your group or team on the Future of Money. Need help optimizing your brand’s customer experience? Reach out and get the insights you need to make the right decisions.

About the Logica Future of Money Study

The newest insights in the latest wave of our ongoing study are based on data collected from a nationally representative group of 1,000 American adults balanced on gender, income and generation. An additional 200 older Gen Zers (age 16-23) were also included for generational comparisons. The results illustrate how people have continued to change their approach to making, spending, saving and investing money.